PRINCIPAL INVESTMENT AND ASSET MANAGEMENT

- Professional asset management and principal investment services for institutional and private investors, combining deep regional expertise with disciplined portfolio oversight and transparent reporting

- Structuring and managing investment funds

INFRASTRUCTURE, UTILITIES AND PROJECT FINANCE

- Financial structuring and advisory for utility and infrastructure projects in:

– Telecommunications

– IT & Media

– Energy generation and distribution

– Airport construction and concessions

– Road construction and rehabilitation

– Urban water supply and distribution

– Waste management

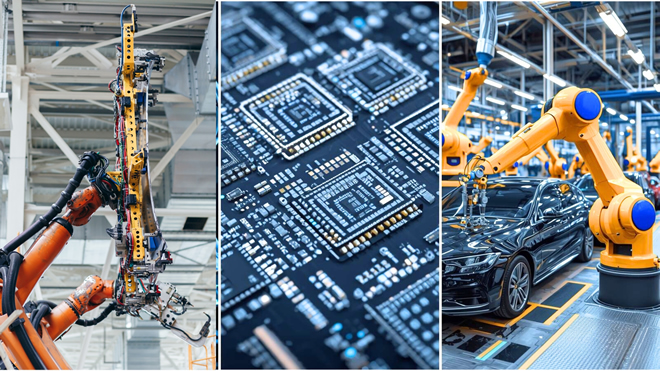

INDUSTRIALIZATION FINANCE

- Access to a portfolio of industrial technology companies driving Europe’s reindustrialization with focus on strategic sectors including advanced manufacturing, semiconductors, green industry, and circular economy solutions.

- Professional Fund Management

- Providing the capital and strategic support needed to scale manufacturing, expand internationally, and strengthen operational resilience.

SUSTAINABILITY FINANCE

- Advisory and financial structuring for electricity generation projects (solar, wind, hydro, biomass, battery storage).

- Transaction support for investments in green technologies and sustainable infrastructure.

- Financing solutions for waste-to-energy and resource-recycling projects.

REAL ESTATE / DATA CENters

- Principal investments and advisory early and medium stage of data centers

- Advisory on real estate disposals and acquisitions

- Structuring real estate sale and lease back transactions

- Feasibility studies and project finance advisory for real estate

FOOD AND AGRICULTURE FINANCING

- Access to a scalable institutional product built around food security companies projects and companies in the CEE

- Professional Fund Management

- Growth capital and financing for expansion, consolidation and scaling of agricultural production Support in integrating supply-chain functions and partnerships with agri-tech operators and software providers

M&A

- Potential target/investor screening

- Transaction structuring and execution

- Company valuation

- Liaison and negotiation with relevant authorities

- Assistance in negotiations with owners/managers of the targets

- Support during closure of privatization and M&A transactions

BROKERAGE

- Advisory and execution of new equity and debt issuance, including eurobonds, local bonds, loans, and Schuldschein instruments.

- Brokerage and trading services (licensed Romanian Stock Exchange and Bulgarian Stock Exchange broker-dealer via BAC IP EAD. IPO partner of Warsaw Stock exchange.

- Sales, trading, and equity research

FINANCIAL INSTITUTIONS AND CAPITAL MARKETS

- Bank valuation

- Advisory on debt & equity issuance for sovereigns, municipalities and corporates

- Sovereign and corporate debt restructuring

- Risk management advisory including hedging solutions

- Debt buy-back

- Fixed income strategies